Funny how it manages to roll around, year after year. The cooler evenings and changing of the leaves also means property taxes are soon arriving in our mail boxes. The statements are usually mailed out mid October and are due to be paid, this year, on November 17th.

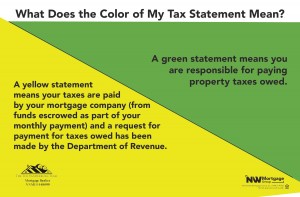

I always get questions from new home owners about what they receive in the mail. If you pay your taxes monthly into a reserve account that your lender manages, then your statement is simply that, a statement. It will be yellow in color. Your lender will also receive this statement. They will see to it that your taxes are paid from your reserve account. If you pay your own taxes, then your statement will be green. You can get a 3% discount if you pay them in full by November 17th. You can also break them up in thirds and pay 1/3 November 17, 2014, February 17, 2015, and May 15, 2015.

Another confusing concept is the fact that the statement has two valuations. One is tax assessed value and one is market value. This exists because we have annual tax increase limitations that don’t follow the real market value, thus you receive two values. I am not too impressed by the real market value the county puts out, but it is interesting. As long as the tax assessed value remains lower than the market value, your taxes will increase each year, usually 3%.

Another confusing concept is the fact that the statement has two valuations. One is tax assessed value and one is market value. This exists because we have annual tax increase limitations that don’t follow the real market value, thus you receive two values. I am not too impressed by the real market value the county puts out, but it is interesting. As long as the tax assessed value remains lower than the market value, your taxes will increase each year, usually 3%.

If you think your assessed value is too high, you should consider contesting this valuation. If you have been a reader for sometime, you may recall I successfully contested my Mother’s tax assessed value about 2 years ago. Going through the process, her property taxes dropped about 30%. For the county website to get info on this, click here. Please also feel free to pick up the phone and call me (503-803-6298). I’d be happy to help you understand the process. The window of time to contest taxes is short. This year it is from October 20, 2014 to December 31, 2014. So if you are thinking of doing this, get started NOW.

As always, thanks for reading.

Dianne