I want to talk about the elephant in the room, rising interest rates. Just yesterday the Federal Reserve raised the Federal rate by .5% to between $4.25 and $4.5%.

The Federal Reserve Rate is the rate set by the Federal Reserve to dictate the cost of money when banks borrow from one another. If the banks are paying more for money, it just makes sense that the increase gets passed along to the consumer. That is how banks make money. It’s why they are in business.

I do think that the increased cost of mortgages is having a impact on the real estate market. Higher interest rates make homes less affordable. Is this going to cause a housing decline? In a word, no.

From what I have been hearing the current situation is likely short term

Several months ago I listened to a Bloomberg podcast that featured 3 economists. The consensus was that the inventory is so low, that the demand for housing will keep the real estate market strong.

At the beginning of the Great Recession, in about 2008, builders pretty much not only stopped building, but they also stopped laying the ground work for new neighborhoods. Coming out of the recession, in about 2014, the home building industry rebounded, but there were about 6 years of missing inventory and they just simply have not caught up, even to this day. To meet our population needs, Nationwide, we should be building 3,000,000 new housing units per year. These are houses, condos, and apartments. We have only been building 1,300,000 per year: not even half of the population need. It is going to take decades to catch up.

Economics is all about supply and demand. With the demand high and supply low, that supports housing values.

The other source of some interesting information was a Brian Buffini class that I took on Monday. It featured Lawrence Yun, the chief economist for the National Association of Realtors. Their discussion included several key points:

- Government regulations put into affect after the Great Recession tightened up the mortgage lending industry so that people actually had to qualify for their loans and prove credit worthiness and employment stability in order to get a mortgage. In other words, people can afford to make their payments.

- There is usually a 2% margin between the Federal rate and the mortgages rates. There is an anomaly happening where the spread is currently 3%. This means that the Federal rate can increase without there being an increase in the mortgage rates.

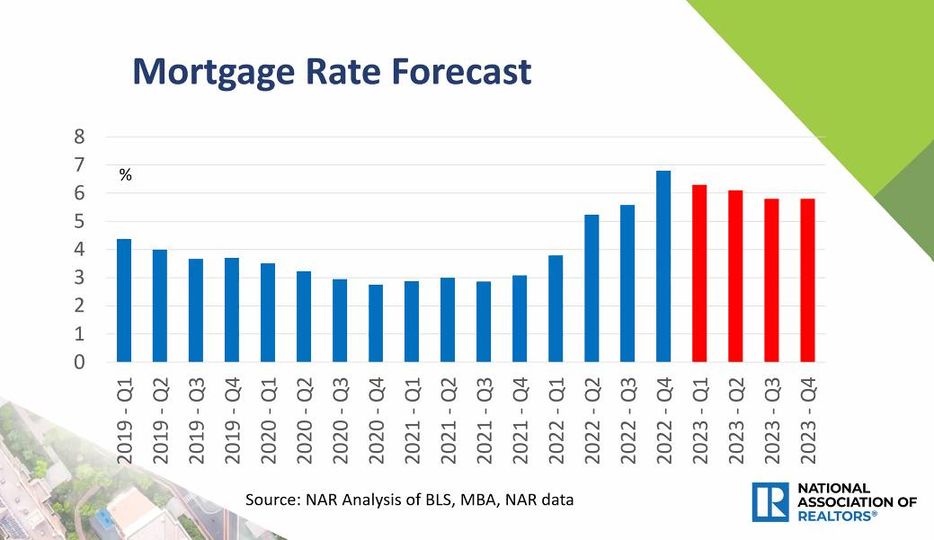

- Mr Yun predicts that 2023 will see interest rates come back down within the year to under 6%

- Mr Buffini predicts that 2023 will be flat with little or no home appreciation. However, he thinks that in 2024 the housing market will rebound with as much as 10% appreciation.

Here are my thoughts. It remains a great time to buy a house. With houses taking longer to sell, people who are selling are more negotiable. For a buyer, that means addressing repairs within the sale and negotiation on the price when you make an offer. For people wanting to sell, the inventory is still very, very low. Yes, it will take 30-60 days, but your house will sell and you likely continue to have a great deal of equity.

I have to say that no one knows for sure. These are simply thoughts shared by people with some knowledge and whose opinions I respect.

As always, thank you for reading the blotter.

Dianne